Dual Life

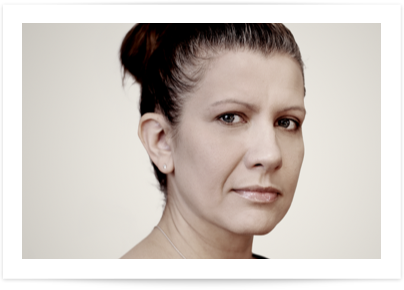

WHEN BECKY LOST HER

HUSBAND, SHE LOST

HER LIFE COVER TOO

5 years ago, Becky and her husband Dave bought a joint life policy. But it wasn’t till Becky made a claim that she realised the flaw in the plan.

A joint life policy only pays out once, on the first death, and is then terminated. So, although Becky received a payout after Dave died, she then found herself without life cover of her own.

It left her in a difficult situation. As a breast cancer survivor with 2 children, she still needed financial protection. But because of her age and medical history, finding cover again would prove costly, if not impossible.

Becky is not alone

22.7%

Of all life insurance

policies sold in 2019

were joint life

Source: Swiss Re, Term & Health Watch 2020

THAT’S WHY, AT GUARDIAN, WE DO THINGS DIFFERENTLY

We don’t offer joint life. Instead, we offer a dual life approach where both partners’ cover is kept separate. That way if either partner dies, the other is still covered.

Our dual life approach still only requires a single quote, application and direct debit. So, compared to the cheapest joint life policy, clients get double the amount of cover for just a small extra cost.

Cost example

£200k level life protection, 20-year term:

Joint life providing

a single payout:

£31.08

a month

V

Dual life providing

2 payouts:

£32.09

a month

IRESS quote: joint/dual life for a 45 and 40-year-old couple, non-smokers, £200k level life cover, 20 years. Joint life policy shows cheapest comparable product. 2 March 2021.

REGISTER FOR A PRODUCT BRIEFING

To find out more about Guardian, join us at our next monthly product briefing with one of our experts.

Our webinars are designed for you to learn more about Guardian and give you hints and tips to grow your protection sales. All our live webinars qualify for CPD.